Portfolio ManagerStructured planner to create a

customised portfolio

Curated PortfolioSimple and quick way to build a

diversified portfolio

Build Your OwnIf you prefer to do it yourself

What Tailwind does differently?

Multi-Asset

Solutions

Invest in multiple financial instruments for all your financial needs.

24/7

Investing

Invest, Anytime, Anywhere with our digital experience.

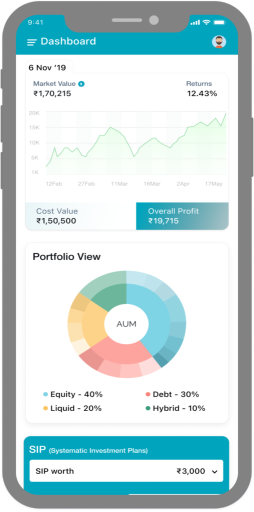

Detailed

Analytics

Reporting in collaboration with Morningstar® providing a 360 degree view of your portfolio.

Family

Level View

We Monitor and manage your entire family’s investments in one place.

Tailored Recommendations

We suggest a variety of investment options after understanding your risk appetite.

Plan the right way with our

Portfolio Manager

1

In-depth

Profiling

Understanding your risk appetite based on your ability and willingness through multiple vantage points.

2

Tailored Portfolio Construction

Providing a plethora of approaches to suit your investment objective and combining it with our market views to tailor your portfolio.

3

Constant Monitoring

Monitoring your portfolio to achieve performance objectives, safety of investments and liquidity requirements.

4

Comprehensive Reporting

Consolidation of all investments for a wholistic view in a detailed performance report.

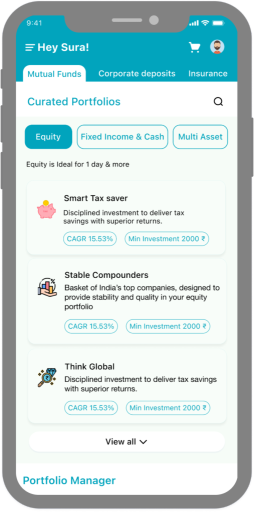

Pick a ready to use

basket of mutual funds

Equity

Stable

Compounders

Basket of India’s top companies, designed to provide stability and quality in your equity portfolio

India Growth

Story

Portfolio with growth-oriented approach which is market capitalisation agnostic.

Emerging

Businesses

High growth stories from emerging sectors with some of the fastest rising companies

Think

Global

Indian markets while providing exposure to the great growth story currently miss out on some of these global mega trends and hence adding international equities can add balance to one’s overall portfolio

Smart

Beta Funds

Ditch your Large cap funds instead opting for these passive funds which mirror indices managed by Nifty and created using rules that have shown consistency in returns

Smart Tax

Saver (ELSS)

Disciplined investment to deliver tax savings with superior returns

Value Investing

and Turnaround

Invest the contrarian way through value picks and turnaround stories

Multi Asset

Growth

Investor

Portfolio is oriented to growth with 65%+ allocation to equity, while balance in fixed income helps in better risk management

All Weather

Investing

Diversified solution across Equity, Fixed Income & Gold to create the ultimate long term portfolio

Dynamic

Allocator

Portfolio that aims to assess market conditions and pick the optimum Equity – Fixed Income allocation

Conservative

Investor

Stability of fixed income with upto 30% equity allocation to enhance overall portfolio returns

Debt

Why Settle for 4% in Savings A/c?

Low risk options to deliver higher yields and providing security

Beat the FD

(3 Year+)

Solution aimed at yielding more than your Bank FDs with added cushion of diversification for safety

Beat the FD

(1-3 Year)

Solution aimed at yielding more than your Bank FDs with added cushion of diversification for safety