In a recent expert survey by a leading publication, we were asked an intriguing question – “On a scale of 1 to 10, how would you rate the performance of equity markets in the last one year?”

With a 1% Nifty return for year to date and after having seen a 18,600 high in October 2021 and 1.5 years of 100%+ return, how would you have reacted to this question? We would guess, probably somewhere around 1-4, right?

Well, interestingly, we stand on the completely different side. We had a long debate around whether to score it 6, 7 or 8! Now, hold for horses, we know what you are thinking – How in the world would such a poor run in the markets be scored so highly?

Let us explain our point of view in scoring the market. Performance in absolute terms from our perspective is irrelevant without comparison with alternate options. Simply saying what if, Nifty returned a 20% performance but broader markets or global markets or another equally volatile asset class provided say, 40% or 60% returns. Would you have felt that the 20% performance was amazing or deserved an 8 or 9 score? Ofcourse, not.

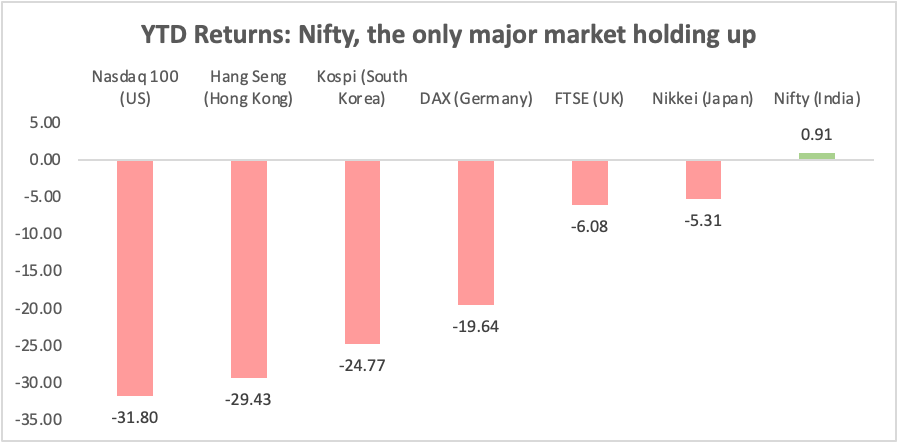

Looking at the year to date (YTD) performance in relative terms provides a better picture. US Nasdaq is down more than 30%, Hang Seng is also close to -30%. Same with other major Developed and Emerging markets, most of whom are down over 5-10%. Even debt funds in domestic markets have given about 1-3% returns due to impact of rising interest rates. Gold and Silver have delivered around -2% to -5% returns.

Now, comparing with these returns, looking at a 1% Nifty performance does not look so bad right? What’s more? While we are aware that the mid cap segment is more volatile, in the same period its performance has been 2%. This is the kind of resilience that Indian markets have exhibited in this year which has seen the Russia-Ukraine war, large sanctions affecting energy and commodity prices, inflation worries leading US Fed to completely flip towards a historic rate hike cycle which in turn sparked worries about recession and China’s lockdown policy to limit Covid spread leading to supply side pressures globally.

Think of it in terms of cricket. On a green top with world class swing bowling, we revered Dravid for his defence. In a way the same parallel can be drawn for how Indian markets have performed this year. As investors, we would love for markets to grow linearly by providing the targeted 12-15% returns annually, but the truth is that bulk of this annualised return is created in a bull market and an important foundation prior to that is minimising accidents in the portfolio in a volatile environment.

Investors would do well to keep this in mind as they sit to review their portfolio and its performance. It would be important to consider relative performance rather than simply looking at a scheme’s absolute performance while taking a decision. At the same time, like we clean our houses in Diwali, a similar clean up would be a good idea for our portfolios as well. With India’s position strengthening globally, a well-positioned portfolio would be able to reap the benefits from the next phase of the market cycle.